As businesses continue to operate in an increasingly competitive and uncertain environment exacerbated by threats to their operations, such as cyberattacks, supply chain disruptions, and climate catastrophes, strategic risk management has become a key factor in ensuring an organization's success.

According to Racounteur, 85% of business leaders feel they are operating in a moderate to high-risk environment, and 79% of boards believe that improved risk management will be critical in enabling their organization to protect and build value in the next five years.

It's clear that organizations need to be prepared for the different types of strategic risk coming their way and have strong strategic risk management in place to not only reduce the impact on their operations but even take advantage of the context and transform it into an opportunity.

In this article, we'll dive into the world of strategic risk, the different types of strategic risks, and how to manage them to reduce the chances of disruption. We'll also give you real-life examples and a ready-to-use, free Risk Management Template to help your business be in strategic control and start your journey toward effective strategic risk management.

What Is Strategic Risk?

Strategic risk is the probability of the organization’s strategy failing. It is an estimation of the future success of the chosen strategy. Since strategy is a set of clear decisions, strategic risk reflects the aggregate of the risks of those decisions.

At its core, strategic risks affect an organization's overall strategy. It can sometimes be difficult to spot and manage.

This means that particularly at an executive level, leaders and teams need to be able to look for strategic risks and, instead of categorizing them as things to hedge or mitigate, develop the acumen to ask the appropriate questions:

- Are we going to resist this, avoid it, or maybe push it away?

- Or do we embrace it, use it as an indicator for the market and take it as an opportunity for a strategic change?

🤓Want to learn more? Download our FREE Strategic Risk Guide (PDF) with examples, definitions, and a clear framework to help you and your organization better manage strategic risk.

What Is Strategic Risk Management?

Strategic risk management is the process of recognizing risks, identifying their causes and effects, and taking the relevant actions to mitigate them. Risks arise from inside and outside factors such as manufacturing failures, economic changes, shifts in consumer tastes, etc.

Strategic risk can disrupt a business’s ability to accomplish its goals, break out in the market or even survive. Effective, efficient management puts the power in leaders’ hands to avoid potential obstacles to success and maximize their performance.

Why Is Strategic Risk Management Important?

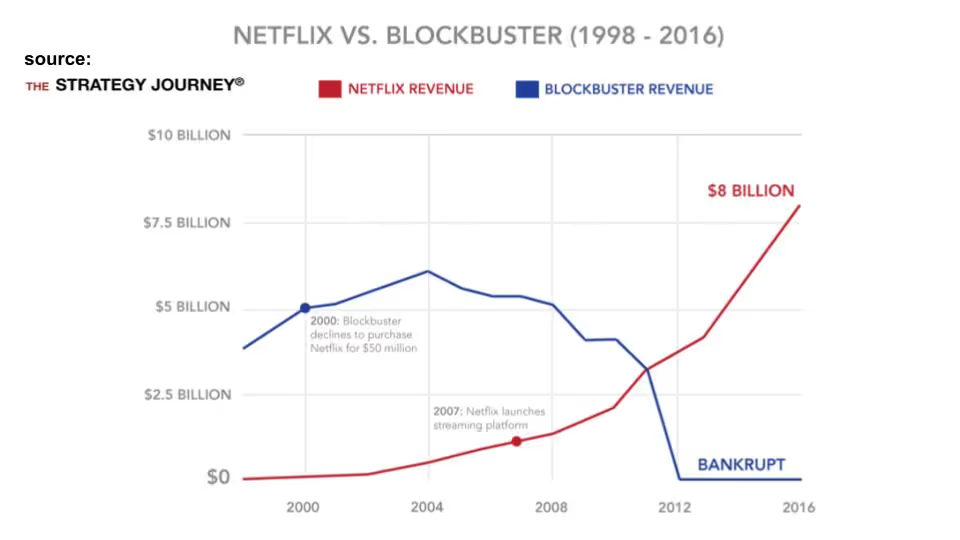

Organizations that fail to do proper risk management face significant threats. At times, they face existential threats. Kodak was a pioneer in the photography space (they actually filed a patent for one of the first digital cameras), but they lost the digital camera race. Blockbuster made $6 billion in revenue at its peak, but there is only one store left in the world! MySpace was once one of the dominant social networks until Facebook came along.

You could argue that these companies failed to innovate. Maybe, but they also failed to evaluate the threat properly and the risk involved in not dealing with it.

Every great company takes risks.

Smartphones, eReaders, car-sharing services, even natural cleaning products — so much of what we as consumers now take for granted was a brave step, once upon a time. But Apple, Amazon, Zipcar, and Method didn’t launch their category-defining products overnight.

These organizations safeguarded their success with a strong risk management strategy. They knew what success would look like, which factors could cause them to fail, what failure could cost them, and how they would respond to obstacles in their path.

Managing strategic risk is an essential activity for all businesses, whether you’re launching an innovative solution to market or just trying to stay ahead of the competition.

Understanding the dangers (however small) and their potential impact (however minor) empowers leaders at different levels to make smart, well-informed decisions.

But that’s easier said than done. Risk management is a dynamic process - it shifts focus as internal and external influences change. It also requires joined-up thinking and communication across an organization.

If you’re tasked with strategic planning and execution within your business, it can seem like an insurmountable task. Yet, armed with the right information, you can help ensure that your organization achieves its goals.

The Two Kinds Of Strategic Risk Factors

One of the first things you need to do to better manage risks is learn to identify them. There are mainly 2 kinds of strategic risk factors that you should look out for.

1. Internal strategic risk factors

Every business has strategic objectives and established routines.

Strategic risk relates to the dangers companies face in trying to accomplish their strategic objectives. Even though your plan might seem viable and on track for success, analyzing the strategic risks involved can help organizations identify obstacles (or opportunities)—and address them before it’s too late.

Strategic risks relate to a business’s internal choices, such as product development routines, advertising, communication tools, sales processes, investments in cutting-edge technologies, and more. These examples all directly impact function, performance, and overall results.

2. External strategic risk factors

Some strategic risks originate outside the company.

These could apply to the current or projected environment into which products will be released.

It’s often easier to understand strategic risk through real-world examples. For instance, a new type of smartphone might be in high demand today, but economic changes could lead to a drop in commercial interest, leaving the business in a totally different position than it might have expected.

Or a competitor may release a groundbreaking product or innovative service that fills the gap first, creating significant risk to the success of a strategy.

And let’s not forget that technology’s swift evolution could cause a new product to become obsolete within a few months—I’m sure that the manufacturers of wired headphones felt their stomachs drop when they saw Apple had cut the headphone jack.

These types of risks pose a real danger to companies. Investing in a business model with little chance of achieving the envisioned success can lead to severe financial strain, loss of revenue, and damage to reputation.

And none of these are easy to recover from.

Strategic Risk Assessment: How To Identify Strategic Risks?

Recognizing and taking action on strategic risks is vital to mitigate costly problems.

In your strategic risk management toolkit, you’ll need two essentials:

- An in-depth understanding of where your organization stands. This includes your target audience, market sector, competitors, and the environment in which your business operates.

- A clear awareness of your organization’s core strategic goals, from conception to proposed execution.

Gathering data on both areas can take time and investment, but it’s worthwhile to achieve accurate insights into strategic risks.

The more information you have to draw upon, the more likely it is that you’ll be able to implement processes and safeguards that facilitate organizational success.

Teams have a choice of different approaches when identifying strategic risks.

Initiate “What if” discussions

Gather employees from across the business to explore ‘what-if’ scenarios.

By mind mapping risk factors collaboratively —with a mix of perspectives and experiences from different departments—Heads of Strategy, Change Managers, and Business Analysts may discover risks they wouldn’t have thought of on their own.

All potential risks are worth considering, no matter how unlikely they may seem at first. That’s why participants should be encouraged to let their minds wander and suggest virtually any viable risk that occurs to them.

It’s best to have a long list that can be reduced through elimination: underestimating risks can lead to businesses being unprepared down the line.

📚 Recommended reading: Risk Matrix: How To Use It In Strategic Planning

Gather input from all stakeholders

Speak with the whole range of stakeholders and consider their views on strategic risks.

If you consult a wide enough group, you’ll gather expanded perspectives about your organization or issues and not just the ones from your core employees.

Collecting a wide range of perspectives creates a holistic view of risk factors which can prove hugely beneficial when trying to understand the dangers the organization faces.

Their broad awareness of how the company operates can raise unexpected possibilities that need to be factored in.

Strategic Risk Examples

The specific strategic risks relevant to your business will largely depend on your industry, sector, product range, consumer base, and many other factors. That being said, there are some broad types of strategic risk, each of which should be on your radar.

Regulatory risks

Let’s demonstrate the importance of regulatory risks with an example.

Imagine an organization working on a new product or planning a fresh service set to transform the market. Perhaps it spots a gap in the industry and finds a way to fill it, yet needs years to bring it to fruition.

However, in this time, regulations change and the product or service suddenly becomes unacceptable. The company can’t deliver the result of its hard work to the target audience, risking a substantial loss of revenue.

Fortunately, the organization had prepared for unexpected regulatory change. Now, elements of the completed project can be incorporated into another or adapted to offer a slightly different solution.

The lesson here?

It’s vital for companies to stay updated on all regulations relevant to their market and be aware of upcoming changes as early as possible.

Competitor risks

Most industries are fiercely competitive. Companies can lose ground if their market rivals release a similar product at a similar or lower cost. Pricing may even be irrelevant if the product is suitably superior.

Competitor analysis can help mitigate this strategic risk: businesses should never operate in a vacuum.

📚 Recommended read: 6 Competitive Analysis Frameworks: How to Leave Your Competition In the Dust

Economic risks

Economic risks are harder to predict, but they pose a real danger to even the most well-realized strategy. For example, economic changes can lead a business’s target audience to lose much of its disposable income or scale back on perceived luxuries.

Customer research is imperative to stay aware of what target audiences desire, their spending habits, lifestyles, financial situations, and more.

Change risks

Change risks refer to the challenges that arise from changes in technology, market trends, consumer preferences, or industry standards.

For instance, a company heavily invested in a particular technology may face significant risks if a disruptive innovation renders their current technology obsolete. Having a strong change management strategy to adapt to change and embracing innovation are key strategies to mitigate this risk.

Reputational risks

Reputational risks arise when a company's actions or associations damage its brand image and public perception. Negative publicity, customer dissatisfaction, product recalls, or ethical controversies can all contribute to reputational risks.

Safeguarding the company's reputation through transparent communication, ethical practices, and proactive crisis management is crucial.

Governance risks

Governance risks refer to the effectiveness and integrity of a company's management and decision-making processes. Weak corporate governance, lack of oversight, non-compliance with regulations, or unethical behavior by key executives can lead to significant strategic risks.

Establishing robust governance frameworks, maintaining transparency, and fostering a culture of accountability are essential to mitigate these risks.

Political risks

Political risks stem from changes in government policies, regulations, or geopolitical events. These risks can impact businesses operating domestically or internationally. Political instability, trade restrictions, sanctions, or changes in tax policies can disrupt operations and affect profitability.

Companies must closely monitor political developments and have contingency plans to navigate such risks effectively.

Financial risks

Financial risks involve challenges related to capital management, funding, cash flow, and financial stability. Factors such as market volatility, credit risks, liquidity constraints, or inadequate financial planning can expose a company to strategic risks.

Implementing sound financial strategies, conducting risk assessments, and maintaining a healthy balance sheet are crucial in managing these risks effectively.

Operational risks

Operational risks are inherent in day-to-day business activities and processes. These risks encompass issues such as supply chain disruptions, equipment failures, cybersecurity breaches, human errors, or natural disasters.

Ensuring robust operational processes, implementing contingency plans, and investing in risk mitigation measures can help minimize the impact of operational risks.

Managing Strategic Risk Vs. Operational Risk

Strategic risks and operational risks are two distinct kinds. While strategic risks originate from both internal and external forces, operational risks stem solely from the internal processes within a business and they stand to disrupt workflow.

However, the biggest difference between them is the level of the decisions they reflect.

Strategic risks reflect the risk of the decisions at a higher level, where the overall strategic plan is considered. The operational risks reflect the risk of the decisions at a lower level, the operational level, where the execution of the strategic plan is outlined.

Simply put, strategic risk is about what you do, and operational risk is how you do it.

Operational risks examples

Operational risks are critical to consider and must be dealt with as soon as possible. They directly impact a business’s work and can tie in with strategic risks, as the resources, processes, or staff available may be unable to achieve the established goals.

One example of operational risk is outdated machinery. They can cause a slowdown in production, delay completion, and ultimately damage employee morale. In this case, the operational risk might stem from what appears to be a non-critical problem but has the potential to drag productivity down to rock bottom. So the decision of whether to upgrade the machinery should be considered.

Another example of operational risk is a company’s current payroll system. Let’s say they outsource to a small team with a weak reputation purely because it’s a cheaper alternative to working with a more reliable payroll solution. But this option could create a higher risk of late payments, processing errors, or other issues with the potential to frustrate the company’s most valuable asset: its employees.

Risk Mitigation Strategies

Implementing effective risk mitigation strategies is essential for businesses to navigate uncertainties and protect their long-term success. By identifying potential risks and proactively addressing them, companies can minimize the impact of adverse events and capitalize on opportunities for growth.

Discuss opportunities and risks separately

This is something that needs to happen before the risk identification process. Mixing in the same conversation potential opportunities and their risks handicaps the opportunity conversation.

You want your people to free their minds, brainstorm ideas, and locate all possible growth and incremental opportunities. Don’t allow that process to shrink and miss out on great opportunities. Discuss risks in a different meeting on a different day.

Distribute resources at the operational level

Once you have decided on your company’s strategy, you’ll have to align every department and person with it.

Allocate your resources in a way that serves your overall strategy to succeed. That means starving certain departments or regions to feed the ones that contribute the most to your strategic objectives.

Mitigating strategic risks is often nothing more than focusing on a great execution of your strategic plan.

Align your incentive structure

Focus on execution takes another form besides resource redistribution.

You have to visit and align with your strategic objectives the incentive structure of your top and middle management. This is a crucial step in executing your strategy because it eradicates internal conflicts.

If your leadership team is rewarded according to an older strategic plan, don’t expect them to take care of your new plan’s risks. They simply won’t have the incentive to do so.

Strategy Risk Management Examples

Let’s examine two specific real-life examples of strategic risk. One that happened a little while ago, and one that is still happening now.

Complacency vs Disruption

Before Netflix, HBO Go, Amazon Prime, Disney +, and all the other streaming platforms, people used to go to Blockbuster.

In its prime, Blockbuster had over 9,000 locations around the world and became synonymous with movie rental. It had a huge slice of the market share and looked pretty peachy until the late nineties. Until 1997, when a little company called Netflix came knocking.

At the time, Netflix didn't stream. It simply delivered rentals in the mail for a set fee each month. There were no late fees (which was one of the biggest gripes from Blockbuster customers), and movie delivery was very convenient.

Netflix was a pretty obvious strategic risk to Blockbuster, which needed to manage it somehow. This could also be seen as a clear opportunity for Blockbuster since they were in a position to buy Netflix but refused to do so.

Yes, Blockbuster passed on the $50 Million deal with Netflix and sealed its fate in the process.

Regulatory complexity

This story is still in development, so who knows how it will end.

Uber is known as the company that shook the cab industry around the world, but things are still changing. Uber is a tech company and understands that change happens, and risk evolves faster than ever before.

This is why they began investing in self-driving technology early on. At first glance, this seems counter-intuitive since moving in this direction could really upset the thousands of Uber drivers out there, but Uber gets it.

They know that if they do nothing, someone else will sweep in and, soon enough, turn Uber into another Blockbuster story.

Uber is a great example of strategic risk management since they not only have to manage things like implementing self-driving cars, but they have also had to navigate through complex regulatory risks in multiple countries.

They have also faced issues around customer safety, assaults, and constant battles with all kinds of protests and regulatory issues.

How To Measure Strategic Risk

So now you know the strategic risks your organization faces, you need a quantifiable figure to measure them. We suggest the following metrics and tools:

Economic Capital

This relates to the amount of equity a business needs to cover any unplanned losses, according to a standard of solvency (based on the organization’s ideal debt rating).

This metric allows businesses to quantify all types of risks related to launching new products, acquiring enterprises, expanding into different territories, or internal transformation. Then, it can take the necessary actions to mitigate against it.

RAROC: Risk-Adjusted Return On Capital

This applies to the expected after-tax return on a scheme once divided by the economic capital.

Companies can leverage this metric to determine if a strategy is viable and offers value, helping to guide leaders’ decision-making process. Any initiative with a RAROC below the capital amount offers no value and should be scrapped (sorry!).

Decision trees

Businesses on all scales can utilize both metrics to measure strategic risk, but the stakes will be different for a small enterprise than for a global corporation. The former may never recover from a bad investment, while the latter has a higher chance of weathering the storm.

As a result, companies may use a decision tree to map the possible outcomes of a decision. This enables teams to determine which choices yield which results and prepare for all eventualities. Specific turning points can be identified and handled appropriately.

The 7-Step Strategic Risk Management Framework

Now you have all the information, you need to capture it in one place: the strategic risk management framework. This is where you bring together all the resources (employees, technologies, capital, etc.) required to mitigate losses caused by internal or external forces.

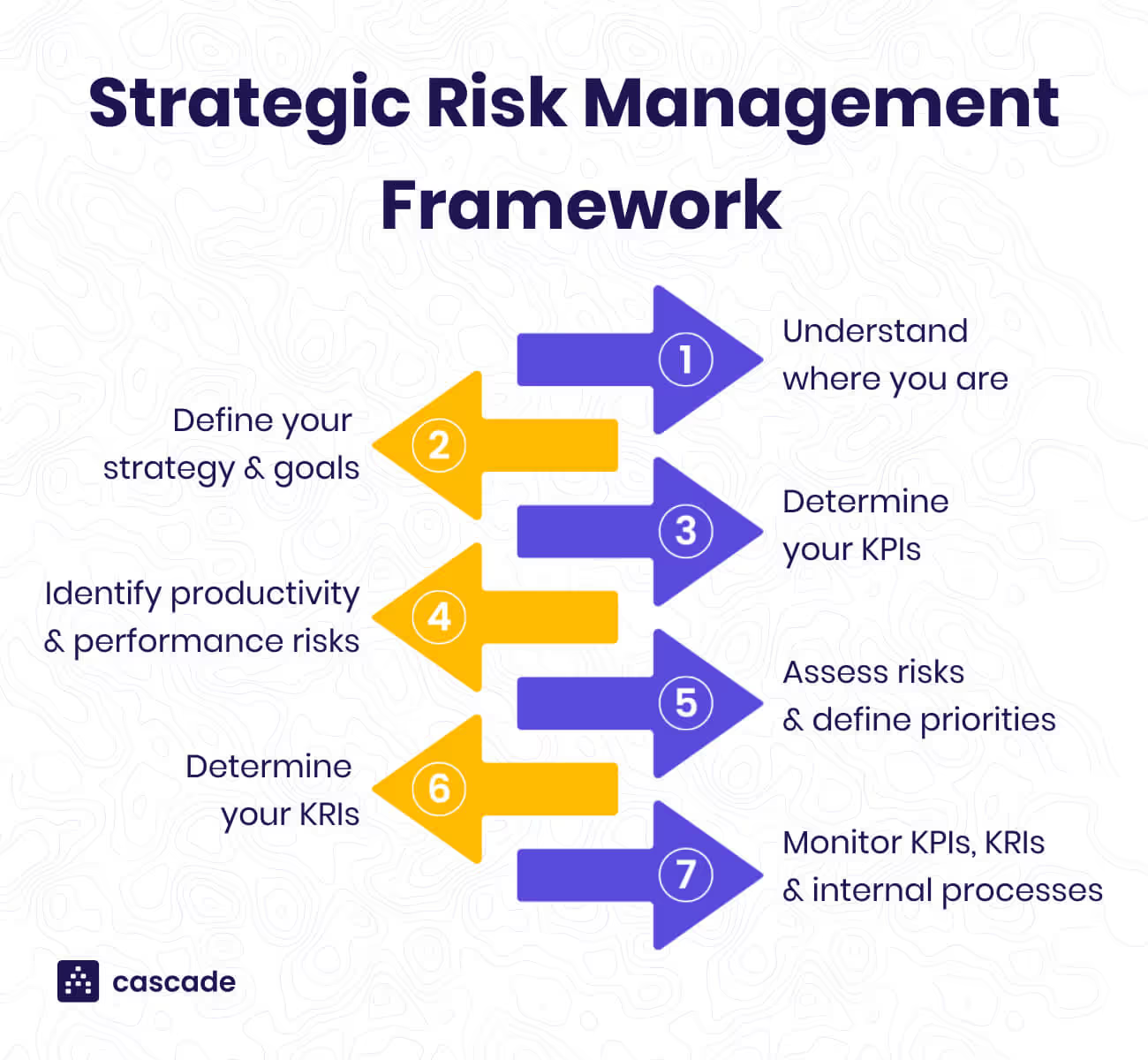

Exactly how your framework is structured is your choice, but the following is a great strategic risk management step-by-step approach:

- Understand where you are right now. You could use a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis, for example. Here you need to know where your organization is, your vulnerabilities, and what threats you face in the market.

- Define your strategy and goals. This is where you clearly outline the strategy for your organization. Check out our free, ready-to-use strategic planning templates to build or revisit your strategy.

- Choose your key performance indicators (KPIs). These can be used to measure success, monitor changes, and explore improvement opportunities over time.

- Identify risks that can affect productivity and performance in the future. These factors may not be as apparent as others. For example, consumers’ changing tastes can be hard to predict but still have the potential to knock plans off the rails.

- Assess your risks and define priorities. You can use a Risk Assessment Matrix that will help you score potential risks based on the probability and the impact on the business.

- Identify KRIs (key risk indicators) to gauge your business's tolerance to obstacles. Be sure to look ahead at issues that may lurk around the corner, and determine the right time to put mitigating actions into effect.

- Continually monitor KPIs, KRIs, and their internal processes to chart progress. Are problems being resolved fast enough? Are target customers’ needs being addressed? Are all essential programs and processes in place? The aim is to stay on track and adapt to ensure you achieve your objectives.

Implement A Long-term Strategic Risk Management Strategy

Managing strategic risk is an ongoing process.

It enables organizations to minimize their danger of experiencing severe losses and, ultimately, failure. It doesn’t guarantee every project will be a success (far from it!), but it will provide all the necessary tools to make better decisions in the long run.

Remember to take your time, even if there’s market pressure to act fast. Trying to rush this process could lead to missed threats or opportunities in your risk analysis. Stay on top of your strategic risk management well into the future, that’s the key to organizational success.

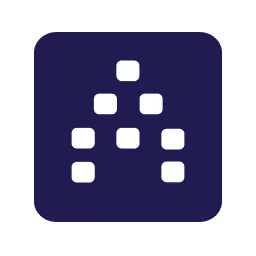

Execute An Effective Risk Management Strategy With Cascade 🚀

Cascade is the world’s #1 strategy execution platform, remediating the chaos of running a business to help you move forward. Cascade serves as your organization's brain, offering a unified platform that spans your entire ecosystem. With Cascade, you can gain a clear picture of potential threats and create a strong risk management strategy to proactively address them.

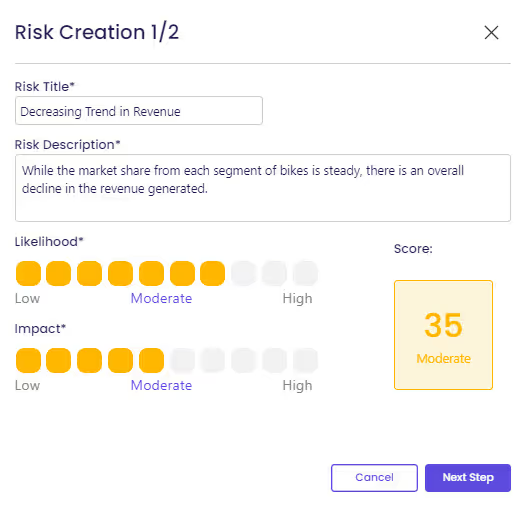

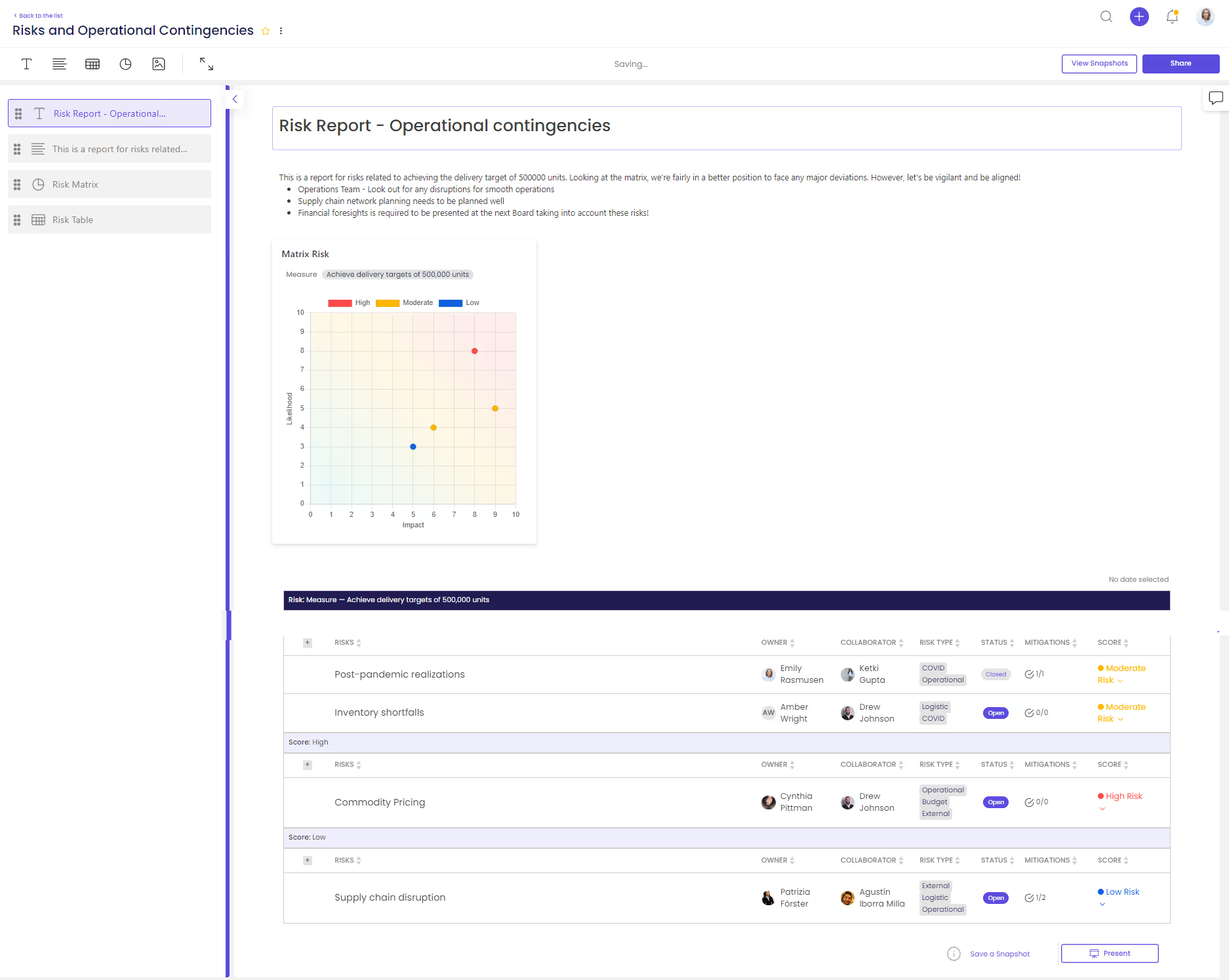

Signal risks before they happen

Once you've identified your risks, Cascade enables you to seamlessly incorporate them into your strategic plan, ensuring alignment throughout your organization.

Adding risks is very simple:

- Give the risk a meaningful title, and a description.

- Define the likelihood (probability of the event to happen on a scale of 1 to 10)

- Define the impact (impact of the risk on the outcome on a scale of 1 to 10)

Based on these factors, Cascade automatically calculates and displays a Risk Score (Likelihood * Impact) to assess the severity of each risk, guiding your decision-making process.

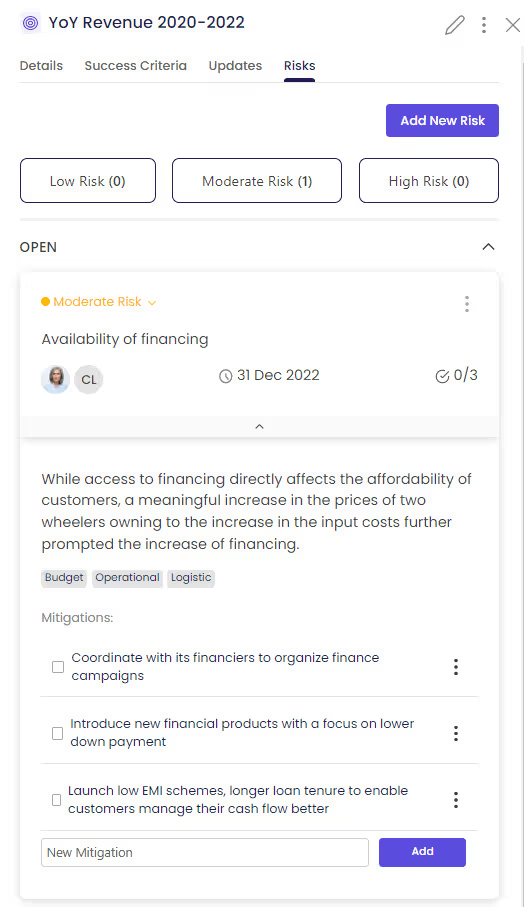

Add mitigations

Cascade empowers you to take proactive measures by adding mitigations to each identified risk. Mitigations are steps that can be implemented to avoid or minimize the occurrence and impact of risks. With a few clicks, you can expand the risk and add relevant mitigations.

As you progress with each mitigation, you can mark its completion using the checkboxes. Cascade keeps track of the number of completed mitigations, providing visibility into your progress.

Report your risks’ progress

Cascade offers a comprehensive risk reporting functionality to ensure that you stay informed about the progress of your risk management strategy. You can easily create detailed risk reports containing essential information such as risk title, owners and collaborators, risk type, status, mitigation status, and risk score. These reports can be saved and shared with stakeholders, enabling effective communication and collaboration.

Create a risk dashboard

Leverage Cascade's Risk Distribution Scatter Plot widget, available in Dashboards or Reports, to visually represent the count of risks within specific entities (e.g., objectives, measures, projects, or actions). The widget provides valuable insights into likelihood, impact, and risk scores, enabling you to monitor and analyze risks effectively.

👉🏼For more detailed information on our Risk Management features, visit our Knowledge Base.

8 Free Strategic Risk Management Templates To Get You Started!

Don’t know where to start? Check out these free strategy templates built by our experts to kickstart your risk management journey:

- Risk Management Strategy Template

- Regulatory Risk Management Plan Template

- Financial Risk Management Plan Template

- Compliance Risk Management Plan Template

- Enterprise Risk Management Plan Template

- Risk Mitigation Plan Template

- Risk Assessment Plan Template

- Risk Response Plan Template

Ready to up your Risk Management Strategy? Get started with a free plan in Cascade or book a demo with one of our strategist experts to help you develop your strategy.

.png)

.jpg)

.jpg)