An American-French company, Danone is one of the leading food groups in dairy products in Europe and North America.

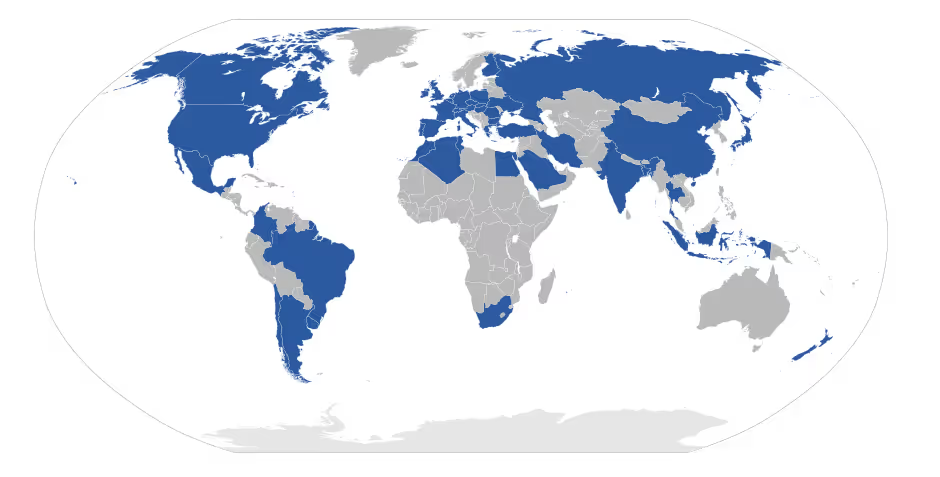

Danone’s success stems from its portfolio. It comprises three primary businesses: dairy products, beverages, and biscuits. With leading brands such as Evian mineral water and Danone dairy products, the company supplies products to more than 130 countries.

Today, Danone’s position is among the top four dairy companies across the globe.

Interesting Statistics From 2021 Highlighting Danone’s Success

- Total Sales of €24.2 Billion

- Net Income of €1.9 Billion

- Global assets worth €45 Billion

- Earnings per share (EPS) of €2.94

- More than 100,000 employees

- Operations in over 120 countries

- Global market share of 21% in the industry

- The stock price of €54.6 as of December 2021

- Ranked #1 in dairy and plant-based products

- Ranked #1 in waters and infant nutrition

Danone pioneered the commercial production and sale of yogurt in Europe and later in the US. It was only after Danone’s yogurt introduction in the United States that the stagnant yogurt consumption in the states shot up. Through smart integration of the beverage and the biscuit industry, it has become a global group owning various well-known brands.

Let’s explore Danone’s journey full of strategizing, diversification, successes, and failures to see how it became a leading food company.

Danone Makes A Mark With Yogurt

Danone started off in Spain with small-scale production of yogurt.

Although yogurt was a common food item, it was not widely available in the market in a packaged form.

To fill this vacuum in the market, Danone did what had never been done before and, in the process, became the pioneer of commercially packaged yogurt.

How Did Danone Start Its Business?

The story of Danone starts in 1919 in Barcelona, Spain.

A doctor named Isaac Carasso began making yogurt under the brand name Danone - the name came from the nickname of his son, Daniel Carasso.

Carasso saw the health benefits of yogurt and felt a business opportunity considering the spread of diseases in the early 1900s.

Therein came Danone’s business model: The gap in the market could be bridged with Danone’s yogurt, with increasing demand as people flocked to the stores for its several healthy properties.

Consequently, Carasso began producing yogurt on a small scale and putting it on pharmacy shelves in the initial days. Within weeks, sales skyrocketed, and Carasso looked towards expansion.

As Danone became a brand name among the public, they moved the stock from pharmacies to conventional stores. Where Danone was only targeting health-conscious customers at pharmacies, stores gave access to a much wider customer base.

The next ten years primarily involved Danone repositioning itself as a dairy products company rather than just a healthy food (yogurt) maker as it moved towards stores and later its outlets.

The Pasteur Institute in Paris had recently encouraged yogurt consumption for its health benefits, so Danone collaborated with them to improve its products.

A century later, Danone would establish its own research nutrition institutes worldwide.

Danone’s Global Expansion Begins With France

Danone’s international expansion came merely in a few years of establishment. In 1929, It opened its first branch in France.

The Société Parisienne du Yoghourt Danone was established by Carasso, who also inaugurated the company's first store in Paris. Danone yogurt was marketed as the ideal dessert for healthy digestion.

Danone became a pioneer in its mission of fusing wellness with fun.

The yogurt packaging came in little porcelain jars that were initially offered in pharmacies before being sold at cheese stands, and the French rushed to sample it.

Throughout the next decade, Danone expanded in Spain and France, opening more and more outlets. Danone had become a brand name in Europe.

Danone’s Strategy To Enter the US Pays Off

In 1942, Daniel Carasso and a Spanish businessman bought a small factory in New York and started making yogurt.

The brand name in the US was changed from Danone to ‘Dannon’ for a more American-friendly pronunciation. They realized this was important to attract local consumers and become a not-so-alien brand in the US.

However, it was not easy for Dannon to establish a stronghold in the US on the basis of its ‘healthy and fun’ marketing. As opposed to today, not many people were health-conscious in those days. So, Dannon had to rethink its strategy of being in the ‘health’ niche.

The Americans took some time to adopt the food. In those days, "healthy food" was typically seen as the obsession of cultists, many of whom were centered in southern California.

It wasn’t until Dannon introduced a strawberry layered version of its yogurt that the US customer started buying it. From ‘Doctors suggest it’ and ‘healthy,’ Dannon had gone to ‘tasty and delicious.’ This variation in Dannon’s standard yogurt marked the beginning of Dannon becoming a household name in the States and played a decisive role in Danone’s international strategy.

Key Takeaway 1: Double Check Your Assumptions Before Expanding To New Markets

The same yogurt that took Europe by storm was not able to penetrate the US market at first. The reason? The difference in the target audience.

People in Europe, particularly France and Spain, were more health-conscious than in America, a country known for its endless fast-food chains. Hence, it was easy to sell healthy food in Europe. But such wasn’t the case in the US. Therefore, the founder of Danone quickly changed marketing strategies with thorough research of the new, international target market.

The business’ name was changed (in the US), and several different flavors of yogurt were introduced to make the product more delicious than it seemed healthy, thereby triggering sales.

Carasso knew that to ensure sustainable business and growth, it is necessary to stay vigilant of any changes in the market as well as research a market while making an entry. What may work in one country may fail in another, therefore, customized targeting remains key to business success.

Danone’s Resurgence in the US

Though it wasn’t easy to start in the US for Danone, they finally began to grow. Having established a name in the US by introducing flavored yogurt, Dannon launched several new flavors and products.

Soon, new production facilities were built in different states to become a nationwide food supplier, that too the first of its kind at the time in the domain of perishable goods.

Danone Sells It’s American Subsidiary

By the mid-1950s, Dannon was making yogurt in six different flavors, accounting for nearly 75 percent of the yogurt produced in the US and generating annual sales nearing 3 million dollars. However, the thrill was short-lived. The Carasso family wanted to shift focus back to Europe operations, and so the American branch was sold in 1959. Beatrice Foods of Chicago purchased it for a price of about $3 million.

This would be repurchased later in the 80s.In the meanwhile, the American business continued to grow exponentially.

What Led To Dannon’s Growth in the US?

Dannon witnessed remarkable growth in its nationwide delivery and introduced a wide variety of yogurt flavors in a market that was very new with low competition.

With the launch of its flavored yogurt, Dannon had become a market leader in the niche. Most competitors were small-scale, limited to certain cities or states. Dannon, on the other hand, was well on its way to becoming a household name throughout the US.

In 1967, Danone merged with Gervais, the leading cheese company in France. Following the merger, the company name changed to Gervais Danone. The merger gave Danone a much wider customer base since the loyal cheese customers of Gervais now followed the name ‘Danone’ after the merger.

Today, cheese is one of the key revenue producers for Danone, hinting at the well-foresighted, opportunistic merger.

Dannon was offering ten different flavors by 1967. About 35 million of the 100 million standard yogurt cups bought yearly in the US were being sold by the corporation.

The process of creating yogurt remained mostly unchanged; bacteria transformed the sugar in pasteurized low-fat milk, allowing it to harden and produce yogurt. Turning to automation had, in this case, significantly improved output for the company.

Being the first corporation to accomplish nationwide distribution for perishable goods, one of the aspects which set Dannon above its, albeit little, competition was its freshness of produce courtesy of timely delivery.

This was exactly why the company would not risk delivery handling to anybody else and self-delivered. Consequently, shipping hubs were created in Philadelphia, Boston, and Washington.

In 1972, a landmark meeting took place between Antoine Riboud, then-Chairman of BSN, and Daniel Carasso, then CEO of Gervais-Danone.

Carasso joined forces with Riboud to explore Danone's expansion because he saw in him an undeniable entrepreneurial aptitude. The announcement of the two firms' mergers followed soon after.

The next year, in December, Gervais Danone merged with the bottle-making company, BSN, forming one of the biggest conglomerates in Europe.

The decades-long experience of BSN and its market share in bottling enabled the new conglomerate to expand exponentially. The thriving brand in the US was becoming a matter of interest for Carasso.

Danone Repurchases The American Business

In 1981, the American subsidiary of Danone was repurchased by BSN, then known as Group Danone.

The US subsidiary had become a huge success and was only a natural choice to be repurchased. The management and shareholders wanted to get back its brand that had grown to new heights in the US.

Dannon had become a remarkable player in the food market. By 1981, Dannon’s yogurt accounted for a whopping one-third of the 1.3 billion containers of yogurt sold annually in the United States. The employee count of the company had crossed 60,000 by this time. In addition to New York City, there were factories in New Jersey, Florida, Ohio, Texas, and California too.

Both frozen yogurt and a yogurt blend called Melange had been presented with success. However, because West Coast retail chains required the goods to be carried to their chilled warehouses, Dannon reluctantly stopped making direct deliveries to West Coast stores in 1981.

By and large, Dannon was now a common household brand in all the states, all thanks to Danone’s global strategy and quick thinking.

Key Takeaway 2: Take Big Bets To Achieve The Extraordinary

In any industry, innovation provides a strategic advantage. For Danone, this didn’t mean some out-of-the-box yogurt or a diary invention but an innovative addition.

They knew that if they introduced something unique and it was welcomed by the public, then competitors would have a hard time gaining significant market share. In such a case, as first-timers or innovators, they reap the benefits but obviously, bear an equal risk.

This is what Dannon did in the US, and not only was it the only brand providing nationwide yogurt delivery, but also quality flavored yogurt, something quite rare at the time. Although a slight addition, a layer of flavor was something new for the people and helped Dannon become a household name in the states.

Any new entrant had a tough time scratching the solid foundations of the consumer base laid by Danone.

Danone Expands Product Line In Quest Of Growth

After a series of mergers and acquisitions, Group Danone began a new phase in its expansion and diversification. BSN had acquired the famous water brand Evian.

Then, Danone’s strategy included entering the biscuit industry by making other major acquisitions.

What Value Did BSN Offer To Danone?

BSN was a colossal bottle-making corporation in Europe with the critical acquisitions of beverage brand Kronenbourg and water brand Evian. BSN became a major player in the glass industry when it formed Flachglass, its first glass-making company, in 1970. Two years later, it bought a majority stake in Belgian glass manufacturer Glaverbel.

These acquisitions provided BSN with over half of the European glass market, together with prior development initiatives in Western Europe.

France became the second-fastest developing industrialized country, following Japan, which made French businesses more competitive.

BSN capitalized on the booming economy and also expanded quickly. In 1973 it merged with Gervais Danone, the biggest food firm in France and the market leader in yogurt, natural cheese, and desserts, and came to be known as BSN-Gervais Danone.

In 1978, it purchased a stake in Alken, a massive Belgian brewery, as part of its strategy to maintain a stronghold in the European beer industry.

A year later, it bought a controlling stake in Belgian Anglo-Belge as well as one-third stakes in the breweries Mahou of Spain and Wührer of Italy. The conglomerate was now well on its way to becoming the top non-carbonated beverage company in Europe.

Following that, the company acquired four French food companies through a swap of equity interests with Générale Occidentale.

This action was bolstered by the French government, which was keen to revitalize the food sector and had even created a unique incentive deal for projects in food processing and food exports.

Through a partnership with Japanese manufacturer Ajinomoto, the company entered the dairy sector in Japan in 1980.

With that, Danone had entered Asian markets and opened broad new horizons for the already colossal company. The firm had witnessed a steep increase in revenues since 1981, and that year it invested a major capital expenditure of more than 2.4 billion francs.

In 1983, BSN-Gervais Danone reverted to calling itself BSN in 1983. The company introduced automated manufacturing lines to boost efficiency and consequently had to let go of 1,000 employees.

The unions protested this decision, but the French government supported it and lauded BSN for its role in modernizing the French industry. By 1984, BSN had fully bought the champagne producers Lanson Pere et Fils and Pommery et Greno, as well as launched a variety of new yogurt products and a new plastic-coated bottle.

Throughout the second half of the 1980s, BSN kept expanding. It bought a minority stake in Verreries Champenoises in 1985 after selling its glass-jar business to that firm.

Additionally, BSN acquired the manufacturer of medicines Bottu, which specialized in painkillers and artificial sweeteners. In the late 1900s, it would initiate a series of divestments as part of a reorientation strategy.

By the end of the 80s, BSN had become a leader in both the beverage and glass market. Danone had gained a competitive advantage.

Danone Expands Its Products Line

The strawberry layered yogurt was just the beginning. As per Danone’s innovation strategy, the company continued to enlarge its variety of yogurt and related products.

Although Dannon's market share had decreased to around 21% by 1985, the U.S. yogurt market had increased to more than a billion dollars by that time.

The firms had been pushing people to "Get a Dannon body" for three years, but now it was introducing new, richer yogurt products to keep up with the competition, which included 125 other brands. Therefore, it became a nearly impossible task for any brand to overcome Danone or even give it a hard time.

The production and the research departments at Danone worked day and night to come up with new ideas.

A French-style blended yogurt known as Dannon Ultra Smooth, another French-style morning yogurt containing raisins, and exotic Danone Supreme, yogurt with more sugar and fat, were all introduced into the market between 1984 and 1985.

"We'll never expand if we're exclusively a medication for diet freaks," Dannon's chairman informed a reporter. With the help of recently launched products and a $13 million increase in advertising spending in 1985, Dannon's market share reached 27% in 1986 – which was more than 1/4th of the industry.

To ensure that it obtained adequate shelf space in supermarkets, the firm, for the first time, started promoting on network television and conducting trade marketing in addition to consumer advertising.

By the time Dannon celebrated its silver anniversary in 1992, it was delivering two million cups per day in a wide range of flavors and variants.

Danone Enters the Biscuit Industry

Having spent decades in the dairy products market; the stakeholders realized that it was too big a risk for Danone that yogurt remained its primary revenue source.

Any supply chain hurdles or global issues could bring the company to its knees.

Being a dairy company that dabbled in yogurt and had already garnered a beverage market, turning to the biscuit industry seemed like a natural transition for the conglomerate. In 1987, Danone bought the global biscuit company, General Biscuit.

This opened a new world of opportunities and markets for the company. General Biscuit owned the world-famous brand, LU Biscuits.

Two years later, Peek Freans and Jacob’s, top international biscuit brands of the European company Nabisco, were also purchased by Danone.

With these acquisitions, Danone’s position was of a global food giant already and a leader in Europe.

Though yogurt was still its primary revenue source, biscuits and beverages now contained a big chunk as too. Having acquired global brands in dairy products, biscuits, water, and beverages, Danone was now a diverse conglomerate in the food industry.

Key Takeaway 3: Diversify With Strategic Acquisitions In Adjacent Industries

Danone had been a pioneer in the yogurt market. It was natural to become a market leader in a matter of a few decades. But reliance on solely yogurt and its different flavors was simply too big a risk. Danone knew it had to expand beyond the horizon of yogurt and its derivatives.

Similarly, BSN had a significant market share in the glass and bottle-making market. It also owned several beverage brands and so the acquisition of Danone allowed it to expand. Furthermore, the group acquired biscuit companies and pasta-makers to diversify its portfolio.

For the business, putting all eggs in one basket – like yogurt – meant spending all savings on one stock expecting a return. Whatever the return, the risk remained too high, and could’ve borne major losses in case of any supply chain issues. A bad milk run, a disease in cows, a natural disaster. Anything could have resulted in supply chain issues or a transformation in demand, and consequently, the once-booming business could’ve turned downwards in its cycle.

So, the management knew that for a company with the scale that Danone had, the product lines needed to be diverse to make sure the revenue was not reliant on a single type of product.

Danone’s Long-list of Acquisitions and Divestitures

The late 1900s were a period of aggressive acquisitions by BSN in different industries. The group began selling various companies to shift its focus back to its three core areas of business. Much of the biscuit businesses were also sold in the next century.

Danone’s Key Acquisitions Across The Globe

BSN slowly started acquiring cookie companies – the new rage – in different continents.

Its ambitious investments into the newly launched markets of South America, Asia, and South Africa, were a defining feature of the early 1990s. BSN started in Eastern Europe by expanding the marketing and production of its existing brands there.

Later, it obtained a controlling interest in businesses, including Russian and Czech cookie manufacturers Bolshevik and Cokoladovny.

In 1990, BSN and an Indian partner formed a joint venture in Asia called Britannia Brands to purchase RJR Nabisco's Asia-Pacific operations.

The venture included the top biscuit manufacturer in India as well as businesses that produced and marketed biscuits, snacks, nuts, and other goods in Singapore, Hong Kong, and Malaysia. Britannia would later become one of the top biscuit producers and exporters in India.

Shortly afterward, BSN acquired the Asian partner's interest and fully assumed management of the Britannia businesses. The company’s expansion also had China in mind.

By the middle of the 1990s, the business had created several joint ventures there that produced biscuits, dairy products, sauces with an Asian flair, and other goods.

In 1994, the business invested 49% of its earnings in Campineira de Alimentos, Brazil's second-largest biscuit manufacturer.

.avif)

1992 saw a lot of coverage for BSN for its involvement in a takeover conflict involving the management of the French spring water business Source Perrier. The only reason BSN made a bid for the entity that owned Perrier was to show support for Nestlé, from which it sought to acquire Volvic, a mineral water label of the famous Perrier company.

The move to sell Volvic for around $500 million was ultimately made by Nestlé. With its addition, BSN now holds the top rank in the world for noncarbonated mineral water.

The Journey From BSN to Danone – Once Again

In 1994, the business was named Group Danone. The BSN name was dropped by the corporation because, in its words, it "seemed to reflect the organization's past rather than going ahead to the future." But the fact that less than 15% of revenues were being generated by the BSN’s original business of glass containers was also a major determinant in the decision. After all, the goodwill of the conglomerate apparently still hinged on the yogurt glory of Danone.

Furthermore, the BSN name was obscure outside of France. The firm decided on the name Groupe Danone since the Danone brand was not only its top global brand but well known in across the globe, contributing to around 25% of revenues, and because Danone goods were made in 30 countries and exported abroad.

The business also changed its logo to show a little boy gazing up at a star at the time, who was thought to represent Daniel Carasso, the nickname of whom had inspired “Danone”. The business then started extending the use of the Danone name beyond dairy products.

Danone's revenues in 1995 were $17 billion, almost twice of what they were six years ago. This expansion was largely the consequence of Riboud's ambitious $5 billion acquisition-heavy worldwide strategies in the last decade of 1900.

In 1996, Riboud picked his son Franck to replace him. A few months later, Danone and Coca-Cola entered into a joint venture through which they agreed to market and sell chilled juice under the Minute Maid and Danone brands in Europe.

Danone Shifts Focus to Core Areas of Business

In 1997, Franck Riboud revealed the adoption of the new company strategy centered on key business areas wherein Danone sort of had global hegemony. These were dairy products, beverages, and cookies, particularly water and beer. More than 75 percent of sales were also concentrated in these areas.

Danone sold all its confectionery operations as well as the majority of its grocery business by 1998. La Familia, Agnesi, and Amora brands were among those disposed of.

It also sold its other grocery-related businesses next year, including the Spanish frozen food producer Pycasa, and the frozen and the ready-to-eat meal brand Marie Surgelés.

Additionally, Danone significantly cut its stake in the glass industry, getting ever closer to its full exit from the original business of BSN. The firm sold all its container business in 2003.

Groupe Danone was looking for further prospects for worldwide growth in its three primary sectors in the 2000s after establishing a much more exclusive emphasis on them.

Most of the group's European brewing operations, including the top brand Kronenbourg, were sold to Scottish & Newcastle in 2000. In 2002, the group sold its Italian cheese business as well as its brewing operations in China.

In 2004, United Biscuits purchased the company's biscuit business in the United Kingdom (Jacob's) and Ireland. The Group sold its sauces division to HP Foods and Ajinomoto in England and the United States in 2005 and Amoy Food and Ajinomoto in Asia in January 2006, respectively.

Danone is still growing worldwide in its core areas despite these divestitures. For the company, the sale of the assets and businesses were part of a refocusing strategy and not a contraction or sign of defeat.

Danone Sells Its Biscuit Brands

In 2007, Danone and Kraft Foods (now Mondelez) had reached an agreement for the sale of the majority of its biscuits division. The deal included the LU and Prince brands but excluded the South American, Bagley and Indian, Britannia for about €5.1 billion.

The same year, the Dutch nutrition and baby foods firm, Numico, accepted a €12.3 billion cash bid from Danone in July 2007, and as a result, the world's second-largest producer of baby food was formed. A pattern could be observed that Danone was moving towards health and sustainability after divestiture in confectionaries.

Key Takeaway 4: When Spread Too Thin, Restructure Your Business!

Acquisitions can be a remarkable addition to a company. They not only bring their experience but a big chunk of market share. However, not all acquisitions are created equal. Some may not prove so marginally beneficial.

The management of Danone realized that while some acquisitions undertaken proved valuable, others by BSN were losing money. Or rather, simply not contributing enough to be maintained by the Danone brand. A hampered working capital cycle and slow growth meant Danone’s resources were tied up with a heavy opportunity cost. They could be reinvested in its core areas and see exponential growth.

Therefore, the management felt it was expanding into way too many fields and led a strategy of selling acquired companies while expanding aggressively in its three core sectors. This proved to be the right decision, as time would tell.

Danone Embraces Digital Transformation

While the company had since been trading as Group Danone, in 2009, it rekindled its roots with the name change to Danone as Danone’s repositioning strategy.

Retracting to its three core areas of business, it began responding to the health-conscious demands of customers. The company has also penetrated the baby foods industry and began strategizing as a ‘health-focused’ and sustainable company.

Danone Becomes A Key Player in Infant Nutrition

Danone’s journey into the baby foods market accelerated when it acquired Numico in 2007. Numico was its Dutch rival in baby foods, and Danone paid a high premium to acquire it.

Danone projected growth in the infant nutrition market. As it was reorienting itself towards nutrition and making institutes, Danone made significant investments in its baby foods product line.

Recently, FDA and Danone have collaborated to bolster the baby food formula supply in the states.

Danone Goes The Extra-mile To Protect The Environment

In line with its sustainability goals, Danone fed the company’s mission by building on prior commitments. Under Danone’s sustainability strategy, the company signed the Ramsar International Convention in 1998 aimed at protecting wetlands.

In 2008, the Danone Fund for Nature was set up. This sponsored carbon offset programs to protect the environment and improve the company’s ecological footprint. In 2009, the Danone Ecosystem Fund was also initiated with a contribution of €100 million. 2 years later, the Livelihoods Fund was launched with the same mindset.

Danone was moving towards a different perspective, the one where they upheld their slogan, “One Planet. One Health”.

Danone Diversifies To Increase Sales

In 2010, Danone stepped into Russia with the acquisition of Unimilk. The group of companies had a stronghold in the local industry, especially in infant nutrition, with brands like Tëma. They also had a vast supply chain and distribution network in the country.

With the acquisition, Russia became one of the biggest consumer markets for Danone, standing right next to France in terms of sales.

However, following the same strategy as the company management had adopted upon expansion to the US, Danone did not try to press its tastes onto the vastly different local market. Instead, they dabbled in innovative new dairy products while maintaining traditional local items on the shelves like kefir (thin yogurt).

In 2012, Danone entered India too with its acquisition of the Wockhardt group’s nutritional branches.

Within a few years, it had penetrated and grown in Africa, too, holding equity in Fan Milk of West Africa, as well as Brookside Dairy Limited in Kenya.

With expansions and a global approach towards marketing, the world had, quite literally, become Danone’s oyster.

While in 1996, over 80% of sales for Danone originated in Western Europe, by 2013, 60% of them had made their place in emerging markets.

Danone had successfully diversified its product and revenue model to suit a global market.

Danone Stays Laser-Focused On The Future

Just as the dairy giant knew it had to innovate and reform with each new expansion, research and development remained high on its agenda. So, in 2013, the company opened Nutricia Research, an innovation center, in the Netherlands. With 400 scientists belonging to over 30 different nationalities, diversity and inclusion remain the formula for Danone’s secret blend to success.

As Danone entered the baby nutrition niche, it also formed several ‘Danone Institutes’. These are non-profit institutes for the sake of research on health and nutrition. This way, Danone was not only fulfilling its CSR but also using these institutes for research on its nutritional products. Today, 11 such institutes exist across the globe, with more than 200 nutritional experts working.

Danone’s Digital Transformation Plan

In keeping with its innovative trajectory, the new world of automation and digitization presented several opportunities for the now overly expanded company.

After all, Danone had spread its wings on almost all continents. Therefore, the company was finding it difficult to manage the vast, decentralized markets, maintain localized catalogs, and control the high spending on its lengthy procurements and promotions.

The answer – going digital with one portal for POSM formats.

With a merged portal that could host a repository of catalogs, Danone was able to efficiently source and better manage operations throughout several geographies. It could also conduct real-time budget checks and collaborate among stakeholders without losing time or money.

Another B2B advancement was the La Serenísima Store, a digital sales channel for Danone’s retailers.

Danone Takes Up D2C Tech

The changing times had touched upon the consumers too, and Danone’s management knew it. Therefore, the company presented digital proposals to improve B2C channels too.

When the pandemic hit in 2020, and the e-commerce market skyrocketed, Danone quickened its digital transformation for the consumer side with a direct-to-consumer website for So Delicious in April 2021.

In the past, when rolling out a new product, it took 6-8 months to know whether it worked or not. With the website and their recent pivot into digitized tech, however, the company obtained real-time feedback and usable results in days. Therefore, Danone began introducing some new products exclusively online – such as Honest To Goodness – to retrieve feedback that could impact future innovation.

Understanding the power that technology holds, the company aims to leverage the newest tech to attain unprecedented success.

Changing Leadership For A Higher Purpose

The Danone brand has since remained fully geared toward the future – technologically or ecologically. It aims to become fully B Corp certified by 2025, which would make it the first international company to achieve this social and environmental responsibility standard.

The company saw a few leadership changes in its years. In 2014, Emmanuel Faber became CEO as Franck Riboud attained the position of Chairman. However, by 2020, when Bluebell Capital became one of the shareholders of Danone, Faber’s leadership came into question as he had been unable to strike the right balance between maintaining sustainability while creating value for shareholders. Consequently, in May 2021, Antoine Bernard de Saint-Affrique became CEO.

Affrique announced in March 2022 that the management has a new plan for Danone, called “Renew Danone.” This strives to further the company based on 4 primary strategies: restoring competitiveness in core categories, selective expansion, seeding future avenues, and actively rotating the portfolio.

Danone communities have been created to encourage the adoption of the sustainable development goals of the United Nations. Danone’s 2030 vision has aligned its goals with the UN’s SDG goals and aims to create long term value – for all.

Key Takeaway 5: Pivot Decisively When You Predict A Disruption

After selling several divisions to refocus on its core categories, Danone knew it had to solidify its competencies and propel itself to meet future needs, if not exceed them. This meant futuristic objectives, digital milestones, and sustainability missions were the foundation stones for decision-making at Danone.

The company invested in innovation of all forms, for its retailers, clients, and the environment alike. It reinvested profits into production as well as R&D, while also giving back to society. When the pace for milestone achievement slowed, the root of the problem was identified, and immediate action taken – such as the change of CEO in 2021.

All in all, Danone knew that to retain its position as a multinational food products company and grow its reach, it had to adapt with its acquisitions, innovate with newer products and tech each day, and extend its service sustainably to maintain shareholder value and goodwill.

Why Is Danone So Successful?

%2520(1).avif)

Today, Danone stands as a French-headquartered multinational foods company with a revenue of more than $28 billion.

The company boasts a significant market share in food, dairy, water, and baby foods and has become involved in several sustainability programs worldwide.

Danone’s Mission

Danone’s mission is: Bringing health through food to as many people as possible.

Danone’s Vision

Danone’s vision is “One Planet. One Health.”

Who Owns Danone?

Danone’s equity remains divided among several hands.

As of the end of 2021, half of the company is owned by Americans, 16% by French investors, 9% by UK, 5% each by Switzerland and Germany, 11% by the rest of Europe, and 4% by the rest of the world.

In terms of corporations, two companies, namely MFS Investment Management and Blackrock contain 8.3% and 5.9% of the equity of Danone, respectively.

Danone’s Growth By Numbers

While the long and rich history of Danone speaks volumes of its success, the statistics below certainly present a quick, compare-and-contrast analysis of how the company has grown in the past.

What Does Danone’s Journey Tell You?

From a mere yogurt maker to a food giant, Danone’s market share, revenue, brand, and international recognition has come a long way. Its key strategies have enabled it to become what it is today.

1. Analyze The Ever-Changing Consumer Demand

One aspect that shines bright in Danone’s case study is that it centers around its consumers. Instead of focusing on what they produced, the company always observed, researched, manufactured, and marketed what was desired in the market. This stood true when the company expanded into the US with yogurt, only to find it to be not as health conscious as Europe, but certainly a fan of tasty foods. Hence they pivoted into new, innovative, and delicious flavors. When Danone extended into Russia years later, they had the same strategy – analyze local demand – and so they did not discontinue traditional products but rather built upon them.

2. Solve The Pain Points Of Customers

Danone’s innovation in decision making often proved that you don’t always need big bucks to make your place in the industry. Nor do you always need extraordinary, out-of-the-box ideas. The idea can be as simple as a can of yogurt equipped with the smart solution to capture market share entailed focusing on an efficient supply chain – something that lacked in the competition.

Similarly, when the pandemic gripped the world in 2020 and e-commerce skyrocketed, the company immediately knew they did not need to focus on the pharmaceutical front or move away from their main product portfolio; they had to go digital! And so, they did just that.

3. Manage Risks With Foresight

The management was certainly aware, as are most competent leaderships, that it’s not always the best to put all their eggs in one basket. However, the company did not simply diversify left, right, and center. They looked at the charts, analyzed their business’ trajectory, and streamlined paths that their yogurt-centered business could tread, such as nutrition and baby food. Consequently, the Danone brand grew to become a multinational, foods company.

4. Stick To Your Guns Through Thick & Thin

While Danone was keen to diversify, it never forgot its roots. This shone when it changed its name to Danone again and became laser-focused on its core competencies in later years. While some acquisitions were made in-line with evolving trends, they were divested quickly when they failed to gel-in with the business’ core product lines, such as sauces and biscuit companies. All while the company continued to march in favor of its prime categories, namely water, dairy, and baby food.

5. Leverage New Possibilities For Growth

Innovation has always been a priority for Danone. Whether it meant coming up with different flavors for yogurts, merging with a water company, entering the world of biscuits, or creating innovation centers throughout its branches, the company has always invested in its growth. When the pace of advancements grew, such as with digitization, the company’s management never shied away from using the latest in tech and AI to bolster results. From creating websites, embedding portals, and building R&D centers, Danone stays steadfast on its path of learning and growing.

Today, Danone is the #1 food and dairy products company in Spain, and Italy, and the third biggest in Europe. Ranking seventh worldwide in food companies, Danone is the top dairy brand, and its water brand Evian ranks #1 in the mineral water industry worldwide. What’s incredible is that even after a century, the Danone brand seems to be continuously climbing the ladder of success and all set for growth in the future.