Bank of America is one of the top financial institutions in the world, offering banking, investing, asset management, and other financial and risk management products and services to millions of its customers globally.

Bank of America’s market share and key statistics from 2021

- Total revenue (net of interest expense) of $8.9 billion

- Market capitalization of $359 billion

- Total assets worth $3.2 trillion

- Stock price of $44.5 as of Dec 31, 2021

- A workforce of 208,000 employees

- Offices in approximately 35 countries worldwide

- Around 41.4 million verified digital users

You've looked at the impressive stats; now, let's discover how Bank of America evolved from a small bank in San Francisco to become one of the world’s leading financial institutions.

Humble Beginnings: how did the Bank of America start

The humble beginnings of Bank of America date back to 1904 and an Italian-American named Amadeo Peter Giannini.

Giannini had a vision to create a bank for people who had never used one and the bank's philosophy was to "serve the little fellows."

Unsurprisingly, he later became renowned as "America's banker" due to his lasting influence on the American financial sector.

But what was that influence? Let’s explore.

From Vision To Formation: Bank Of Italy Opens Its Doors

Giannini was based in California and noticed that many regular people, particularly immigrants, were turned away from numerous banks.

The number of Italian immigrants in California at the time was on the rise, yet none of them had full access to even the most fundamental financial services. Only the wealthy had access to banking services, forcing many people to use questionable methods like loan sharks.

Being an Italian himself, Giannini saw a chance to expand banking to all people, not only the wealthy clientele.

He then sold 3,000 shares of stock, mainly to small investors, to generate money for his new bank located in San Francisco—the Bank of Italy.

As soon as the Bank of Italy opened its doors, customers swarmed and signed up for its services. On its first operational day, people deposited approximately $8,780 (equivalent to $288,350 now), and over $700,000 were deposited in the first year (equal to $20M today).

The Growth Of The Unorthodox Bank

Since the Bank of Italy was Giannini’s first branch banking endeavor, he made up the rules as he went along.

By going his own way and openly criticizing the "big interests," Giannini regularly upset key financial industry members, including local bankers and influential state and federal authorities’ members.

He eventually hit the streets and promoted his bank door-to-door, attracting an increasing number of customers. This was completely new as other banks hadn’t used this technique before. In the process, he also explained the value of financial security and banking fundamentals. He taught them about things like compound interest and how to open a bank account, among other things.

Giannini’s out-of-the-box policies made the Bank of Italy and its successor, the Bank of America, one of the most contentious banks in the US.

Perhaps the most unique policy of the Bank of Italy was that it allowed anyone to open a bank account and request a loan. In fact, workers were eligible for loans from the bank starting at $25. This meant that more clients could obtain loans despite the lesser denominations.

Borrowers from the Bank of Italy could even prolong their payment terms without paying any additional costs, and it had the lowest lending interest rates.

Eventually, the bank’s deposits and regular clients continued to grow despite the then-unusual banking practices, and it witnessed exponential growth since it catered to everyone.

Because of its unique yet successful policies, the Bank of Italy beat other banks in terms of financial performance. However, after only two years in the business, its first catastrophe began to brew.

Bouncing Back From The 1906 San Francisco Earthquake

On April 18, 1906, over 80% of San Francisco was destroyed by a powerful earthquake, and a large part was burned down by fire. Of course, the banking sector was not spared from this catastrophe.

Apart from the metal vaults, the fire completely destroyed many bank buildings. However, there was a widespread belief that the cash and records were secure inside.

Unfortunately, the fire had heated the cash vaults to the point where many banks could not safely open the vault for days or weeks, depriving customers of access when they most needed their money.

The Bank of Italy was fortunately located outside the city. So, although the disaster affected numerous banks, the Bank of Italy was among the first to resume operations. In fact, Giannini established a makeshift bank once the fires were put out, and business was conducted as usual there.

The bank started providing loans to locals and vendors who required money to restore damaged homes or businesses and immediately gained media attention.

The Bank of Italy built its reputation on openness and trust while assisting in the city's reconstruction.

Key Takeaway #1: A unique vision works like a strategic compass

By the 20th century, it became evident that one bank stood out more than most: The Bank of Italy.

Starting from scratch in 1906, the bank came into being with a vision. A vision to make life easier for people, especially the underprivileged.

At a time when having a bank account was a luxury reserved for the wealthy, it pioneered the first step toward widespread financial literacy and easy access to bank accounts.

Eventually, the Bank of Italy’s strategy proved fruitful as it provided financial access to the masses and grew based on volume.

The bank also displayed incredible resilience, especially during the San Francisco earthquake of 1906, and took it as a chance to offer help to those in need and automatically build a name for itself.

The Bank of Italy remained undefeated due to its undeniable efforts toward putting the people first and its leadership's ability to recognize the gaps and propose suitable solutions.

Ups And Downs In The Early 20th Century Define Bank of America

From the end of the American Civil War until about 1900, there was virtually little to no branch banking in the United States due to the National Bank Act of 1853.

Banking corporations were generally restricted to one office as public policy promoted the unit banking system.

However, things started to change for the better in 1909 when the State of Washington Legislature passed modified banking regulations, allowing banks to expand into smaller branches throughout California.

Expanding And Excelling Through Customer Service

In an effort to expand its clientele and further stabilize the financial system, the Bank of Italy ventured out to San Jose to acquire a local bank as its first branch. And this is not where it stopped.

The acquisitions persisted over the years, and by 1918, there were 24 Bank of Italy branches, making it the first bank to have statewide coverage.

Later, the Bank of Italy created new departments where bank tellers and staff could speak multiple languages to provide their customers with the convenience of conversing in their own language.

Not only this, but the bank also established a female-only office to better serve and support female clients in response to the rising number of women running their own businesses.

Clearly, even decades before inclusivity was given proper attention, Bank of America’s inclusivity strategy was way ahead of the times as the bank left no stone unturned to facilitate its customers.

The Merger of the Bank of Italy and the Bank of America

To accelerate growth in Southern California, the Bank of Italy then reached out to Orra E. Monnette, president of the six-year-old Los Angeles-based Bank of America, in 1928 to consider a merger.

The LA-based bank caught Bank of Italy’s mastermind Giannini’s attention because of its streamlined accounting and cash distribution network. While other banks kept larger amounts on premise and away from investment objectives, Orra’s Bank kept its branches stocked with limited amounts using its own safe fleet of armored cars.

Eventually, both founders decided that the new bank's name would be The Bank of America to prepare itself for expansion throughout the country and the merger took place in November of 1929.

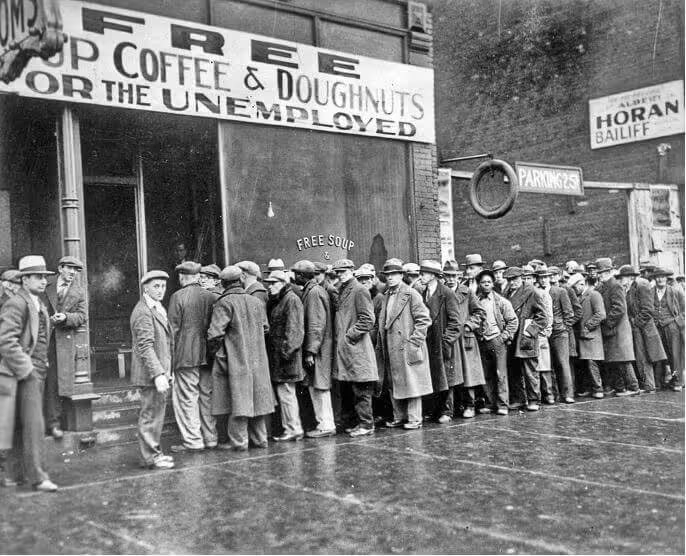

Surviving The Great Depression Of 1929

Shortly after the Bank of America formed, it was presented with a catastrophic event—the Great Depression of 1929.

Late in October 1929, the stock market crashed, wiping off 40% of the common stock's paper value. Over the course of a few days, the stock market continued to decline, which started off one of the most disastrous times in American history.

This crash affected the entire US financial system, and banks were no exception. Several banks collapsed; however, the Bank of America could withstand the test of time.

Despite the Depression, the Bank of America continued to grow throughout the 1930s, so much so that another addition to its already existing 4 headquarters in San Francisco was needed.

Key Takeaway #2: Build to adapt and be resilient

Bank of America flourished in prosperous times and survived difficult times.

Instead of fighting change, the bank embraced it. It provided its customers with exceptional customer service with its transparent and inclusive banking policies.

Moreover, it never stopped seeking fresh approaches to maximize its shareholder value. The bank continued to grow by making several large and small acquisitions and introducing multiple branches nationwide.

Not only that, Bank of America displayed incredible resilience throughout the Great Depression and stayed true to its motto of being "the people's bank."

Bank of America’s Strategy In The Middle & Late 20th Century

By now, we've seen how Bank of America stood strong through thick and thin, owing to its brilliant strategies.

However, that was just the beginning of a series of remarkable breakthroughs and incredible growth. Let's dive into it.

Bank of America’s Innovation Strategy

By 1936, Bank of America’s business strategies had made it the second-largest savings bank in the country and the fourth-largest banking institution in the US.

The bank kept up its innovative streak by launching a line of new loans known as Timeplan installment loans. These comprised of real estate loans, new and used car finance, personal credit loans ranging from $50 to $1,000, and home remodeling loans—all firsts for their respective industries.

Bank of America was also the first bank in the United States to use electronic and computerized record-keeping; by 1961, all business processes were automated.

Additional initiatives launched by the bank included student loans, an employee loan-and-deposit program that allowed employees to do banking transactions through their offices, and the first widely used credit card—BankAmericard (the forerunner of Visa).

From Troubling Times In The 1980s To Making A Comeback

Bank of America’s journey was not without challenges.

Everything started to fall apart when Tom Clausen, CEO who was largely responsible for Bank of America’s success, resigned in 1981 to lead the World Bank.

Energy loans, farming loans, shipping loans (Bank of America was the largest agricultural lender globally), and loans to developing nations—all started defaulting. What’s more, despite being previously highly liquid due to its substantial deposit base, the bank was not ready to handle the crisis.

Suddenly, the largest bank in the world was insolvent, and in 1986, a firm half its size—First Interstate Bancorp—made a takeover offer to the Bank of America.

However, Tom Clausen quickly resumed the CEO role at Bank of America and rejected First Interstate's offer, and subsequently, the bank began revamping its business operations in 1987.

The bank disposed of its non-essential assets and turned its focus back to the domestic market. Customers from California were drawn back by new services, including sophisticated automated teller machines and increased banking hours. Additionally, it purged its portfolio of nonperforming loans and engaged several outstanding managers to carry out the company’s new objectives.

By the end of 1988, the bank was back in the game again. In fact, industry experts dubbed the recovery as the largest turnaround in American banking history.

The 1998 Bank of America and NationsBank Merger

NationsBank was one of the United States' largest financial companies. The North Carolina-based business expanded quickly in the late 1980s and early 1990s and quickly soared to massive success.

In 1998, NationsBank approached Bank of America about the possibility of merging the two companies. After much deliberation from both sides, the deal eventually took place on April 13, 1998, in a $62 billion merger.

The combined company, called the Bank of America Corporation, established its headquarters in Charlotte and provided services to consumers in 38 different countries as well as 30 million households in the United States.

However, integration issues hampered Bank of America throughout 1999 and into 2000, causing it to report lower-than-expected revenue growth, net income, and earnings. The corporation blamed its dismal financial performance on credit issues and poor loans. As a result, Bank of America’s business strategy was restructured to improve efficiency.

Bank of America's then-CEO, McColl, retired in April 2001, handing the reins to Kenneth D. Lewis as chairman and CEO.

Under new leadership, Bank of America redirected its attention to independent development after years of prioritizing deal-making. In order to improve Bank of America’s brand image, the new management also increased its advertising spending for 2002 by 50%, reaching $145 million.

When the dust settled on the BankAmerica-NationsBank merger, the new Bank of America ranked as the third-largest bank and thirteenth-largest corporation in the United States.

Key Takeaway #3: Act Fast and be decisive

Let's be honest: even if you believe you are headed in the right direction, not everything always goes as planned. You’ll lose…time, customers, and money.

The same was the case with Bank of America.

Even with Bank of America’s remarkable innovation and ahead-of-the-time services, it faced numerous challenges along the way – that's just how the business world operates.

The point here to note is that you should prepare yourself for any and all kinds of circumstances. Never back down from taking hard decisions and embrace solid strategies. Make sure you have contingency plans in place and when push comes to shove, act decisively and boldly.

Bank of America’s Growth Via Strategic Acquisitions & Digital Transformation

After its merger with NationsBank, Bank of America continued to grow over the years with multiple mergers and acquisitions.

Getting Hold Of LaSalle Bank Corporation And Countrywide Financial

In 2007, the Federal Reserve permitted Bank of America to purchase LaSalle Bank Corporation for $21 billion.

With the acquisition, Bank of America gained 411 branches, 17,000 business bank customers, 1.4 million retail clients, and 1,500 ATMs across Illinois, Michigan, and Indiana. With 197 locations and 14% of the deposit market, Bank of America has surpassed JPMorgan Chase to take the top spot as the largest bank in the Chicago area.

Next year, in 2008, Bank of America announced that it would acquire Countrywide Financial for $4.1 billion.

After the acquisition in July 2008, Bank of America’s market share in the mortgage industry and access to Countrywide's resources for mortgage servicing massively increased. With a 20–25% market share, this acquisition made Bank of America Corporation the largest mortgage originator and servicer in the United States.

Bank of America’s Digital Transformation Strategy Sets-Off

As part of its new plan to enter the digital space, Bank of America’s strategy was to focus on expanding its mobile banking platform. By 2014, it had 16 million mobile and 31 million active online users.

In fact, as a result of rising mobile banking usage and a drop in clients’ branch visits, its retail banking branch count had fallen to a mere 4900 compared from 6100 just 5 years earlier.

Making Continued Expansion A Habit

In 2015, Bank of America’s business strategy focused towards organic growth by opening branches in towns and cities where it had no prior retail presence.

So, to complement its already-existing commercial loan and investment businesses in the region, Bank of America announced in January 2018 an organic expansion of its retail footprint into Pittsburgh and neighboring areas.

Prior to the expansion, PNC Financial Services (a local company) had a substantial market share in Pittsburgh—one of the biggest US cities without a retail presence by any of the Big Four banks.

In terms of deposits, Bank of America had risen to become the 16th-largest bank in Pittsburgh by 2020, and in 2021, it reached the 12th position.

Additionally, in February 2018, Bank of America also declared its intention to enter Ohio, a state where Chase enjoys a stronghold. After entering Ohio, the Bank of America quickly rose to become the fifth-largest player in Columbus (by deposits) within a year. As of 2022, it is the ninth-largest bank in all of Ohio.

Key Takeaway #4: Jump on opportunities early

Even after being in business for years, a company’s growth does not have to come to a standstill.

Given the right techniques and the right acquisitions, any business can reach new heights.

After its merger with NationsBank, Bank of America took part in multiple other acquisitions over the years that helped it gain greater financial strength and expand its services even in areas where it had never had any foothold.

Why is Bank Of America So Successful?

Bank of America’s immense success boils down to its unrivaled services, especially in the US.

With over 4,300 retail financial centers, 17,000 ATMs, and digital banking with about 41 million active users and about 32 million mobile users, the corporation never fails to disappoint its 66 million consumer and small business clients.

Here are the 3 core principles that primarily guide Bank of America’s strategy:

- Being client-focused

- Driving operational excellence

- Growth, which is both sustainable and within the appropriate risk framework

What is Bank of America’s mission?

The mission of Bank of America is to improve financial lives by providing its customers with the support and resources they need to succeed. It aims to accomplish this broad mission by breaking it down into 3 subdivisions: environmental, social, and governance leadership.

Serving businesses, governments, institutions, and people worldwide, Bank of America is and plans to retain its position of being a world leader in wealth management, corporate, and investment banking.

The company takes pride in its employees, just as much as its broad customer base.

By establishing a culture of involvement and trust, Bank of America is committed to inclusion. The company employs people from different backgrounds and experiences, including diverse races, sexual orientations, genders, ages, and abilities.

Bank Of America’s Growth By Numbers

Strategic Takeaways From Bank Of America’s Journey

Brace Yourself For Tough Times

In order to sustain its long-term growth, the bank has consistently prioritized operational excellence and demonstrated incredible resilience.

Bank of America’s business model, strategy, governance, and risk management systems enabled it to gauge the opportunities and hurdles in its operating environment and provide value to its stakeholders.

From the 1906 San Francisco earthquake to the Great Depression to battling tough lawsuits, Bank of America has always been flexible and agile in response to what may come next.

Never Get Too Comfortable

In today’s age, change is inevitable. Businesses should expand their horizons, explore and make the most of suitable opportunities.

Bank of America has consistently recovered reasonably well from difficult times by being aware of the business environment and never getting too comfortable, even in good times.

No wonder it's constantly seeking out and diving into new prospects to save up for the rainy days.

Look Out For & Embrace The Right Opportunities

One of the best ways for a firm to flourish is by reaching a larger consumer base and expanding its market share—that’s exactly the approach Bank of America has employed for the last few decades.

Bank of America’s strategy not only helps it reduce costs and overheads but also reduces competition and, in turn, increases its revenues. Similar was the case in the last 2 years when Bank of America not only expanded in foreign areas like Ohio and Pittsburgh but also excelled there.